gloaming 2

Wednesday, November 5th, 2008

randformblog on math, physics, art, and design |

Some images from our flight from Tokyo to Frankfurt.

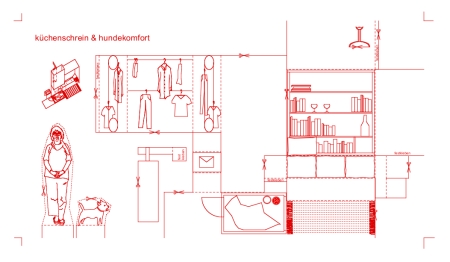

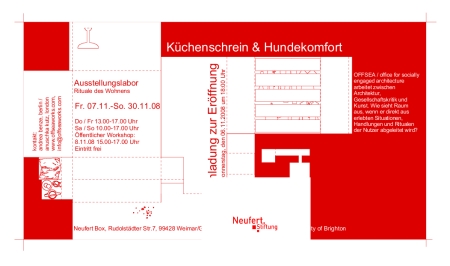

My sister Anuschka Kutz (who lives in London) and her friend Andrea Benze (who lives in Berlin) will have an exhibition/workshop about their project “Küchenschrein & Hundekomfort” (see also here) in Neufert Box, Rudolstädter Str. 7, 99428 Weimar/Gelmeroda

Times:

opening: Do 6.11.08 18.00

Fr 07.11.- So. 30.11.08

Do/Fr 13.00-17.00

Sa/So 10.00-17.00

workshop: 8.11.08

Wie sieht Raum aus, wenn er direkt aus erlebten Situationen, Handlungen und Ritualen der Nutzer abgeleitet wird?

How does space look like, if it is directly derived from experienced situations, actions and rituals of its users?

The below marks on a house in Munichs Schellingstrasse are I think remnants of shootings from the time of WWII. There is a glassplate with the words “wounds of reminiscence” (in german), signed by Passow and Weizäcker, however no explanation so I am not sure.

In Berlin there are also quite some marks like this, unfortunately they are usually covered after rehabilitation and thus the scars of war are getting more and more obliterated. E.g. if I remember correctly the Magnushaus of the german physical society on the street “Am Kupfergraben” was just a few years ago covered with similar shooting marks, the museum right across the street also had some, but they are renovating there too so I dont know wether they are still visible.

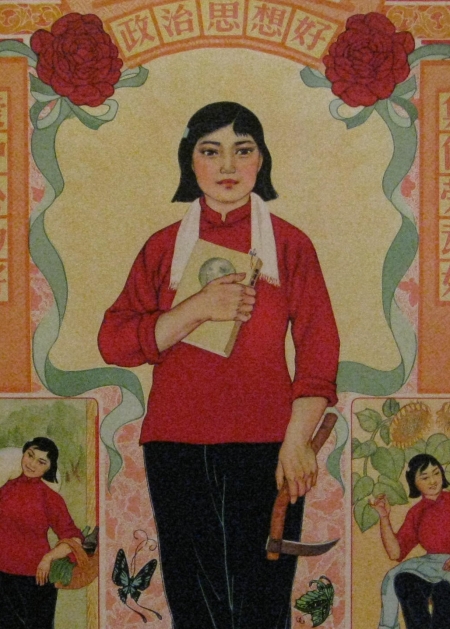

Some images from the recent exhibition at the Fukuoka Asian Art Museum “Visualising the bright future – Propaganda Pictures of New China” which displayed political posters from China. The posters were contrasted with some artwork of more recent artists (like Feng Mengbo, Xu Zhiwei and Ai Weiwei) which supplemented the permanent collection featuring e.g. Lin Tianmiao (please see below).

just some pictures from a beautiful maple:

Despite having somewhat managed the organisatorial tasks of moving we are now subject to other sorts of time pressure which are mainly due to being faced with quite a heavy pile of accumulated work. However I hope this wont result in one blog post per year…annual blogging is not really preferred over here. :)

Due to the financial crisis and maybe since he was part of the consulting team of the new financial market stabilization law the CEO of Deutsche Bank Josef Ackermann waived his bonuses and additional payouts (where one has to say that his rest annual salary is probably still bigger than what I earned in all my life…:)).

Anyways he got a lot of media attention due to this and I guess this was intended.

Nevertheless one is left to hope that other bankers will follow suit and donate their excessive salaries into this fund of 30 billion dollars (This amount of money by the way is in the same order of what the new german law accepted as “security reserve”).

These are not the necessary structural changes in the financial system, which are in principle possible, even on a technical level (see e.g. here) but still – it would be a sign.

In an interview Josef Ackermann was asked (translation (tr) without guarantee):

Bams: Arbeiten die Besten für 500 000 Euro?

(tr:Do the best work for 500 000 Euro?)JOSEF ACKERMANN: Nein. Die Besten bekommen Sie dafür nicht.

(tr:No the best you won’t get for this money)

and later on:

BamS: Sie selbst haben Ihren Bankern 25 Prozent Rendite vorgegeben. Seither gilt diese Zahl als Maßzahl für Gier.

(tr: You yourself had allowed your bankers 25 percent return. Since then this number is a measure for greed.)JOSEF ACKERMANN: Ist es Gier, wenn man möglichst erfolgreich sein will? Das will doch jeder im Leben. Davon lebt unser System. Auch der Wettbewerb um höhere Renditen hat die Menschheit weitergebracht. Diesen Wettbewerb sollten wir auf keinen Fall aufgeben. Die 25 Prozent vor Steuern habe ich mir ja nicht einfach ausgedacht, das ist die Rendite, die die besten Banken der Welt erzielen. Und die Deutsche Bank hat den Anspruch, bei den Besten der Welt dabei zu sein.

(tr: Is it greed if one wants to be successful in life? Everybody wants to be this in life. This is how our system works. Also the competition for higher returns had helped on mankind. Under no circumstances this competition should be given up. I didn’t just come up with this 25 percent before taxes, this is the return the best banks in the world achieve. And the Deutsche Bank has the standard to belong to the best in the world.)

If I understand correctly this means that it’s not the challenge like to save endangered banks, but its the money which makes bankers go. A bit wimpy, no?

It is also interesting what bankers value as “successful”.

In particular I have also some skepticism about “Also the competition for higher returns had helped on mankind”….e.g. by looking at this crisis…

shop widow in Munich’s Amalienstrasse

Today the german “stabilization law” mentioned in the last randform post, which was hastingly put together within a couple of days and which concerns an amount of money which is in the order of the costs of the german unity, is going to be passed.

With it

Since -with this law, it is on one hand in principle possible to adjust the time validity of remuneration obligations via Rechtsverordnung (which means in particular without the need of parlamentary involvement), however on the other hand as indicated on the webpage (same as in last post) there seems to be no intention to do this on a broad scheme. In particular I hereby repeat (like for those with an attention deficit syndrome..:)) the current legislation means that

(for more see last post)

This implies that probably no real changes in the banking system will take place and I am asking myself how this could possibly raise the trust of savers.